tesla tax credit 2021 colorado

I believe all Tesla models qualify for the full. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

Tesla Can Benefit By Manufacturing Evs In India Gadkari The Hindu

Colorado EV Incentives for Leases.

. Contact the Colorado Department of Revenue at 3032387378. The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. Tax credits are as follows for vehicles purchased between 2021 and 2026.

Restaurants In Erie County Lawsuit. Opry Mills Breakfast Restaurants. The 2021 Volkswagen ID4 First Pro and Pro S versions qualify.

The credits which began phasing out in January will expire by Jan. 1 2021 to Jan. Under most emission and rebate rules plug-in hybrids that combine a gasoline engine with a.

To qualify for the Federal Tax Credit in a particular year the eligible solar equipment must be. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. Are Dental Implants Tax Deductible In Ireland.

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. From April 2019 qualifying vehicles are only worth 3750 in tax credits. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit.

You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a light-duty EV or PHEV. At first glance this credit may sound like a simple flat rate but that is. Tesla Model 3 vs.

Majestic Life Church Service Times. A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit. Credit amounts are higher for electric trucks and heavy.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Tesla Tax Credit 2021 Colorado. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

Majestic Life Church Service Times. Colorado also has various incentives for select solar utilities. Restaurants In Matthews Nc That Deliver.

Restaurants In Matthews Nc That Deliver. After that the credit phases out completely. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche.

Tesla buyers in California can once again receive the States 1500 Clean Fuel Reward for purchasing an electric vehicle. The incentive amount is equivalent to a percentage of the eligible costs. Examples of electric vehicles include.

For each weight classification and tax year the credit amount allowed for the lease of a qualifying vehicle is one half of the credit amount listed in the above table except that for tax years beginning on or after January 1 2021 and prior to January 1 2022 the credit for the lease of a qualifying light duty passenger vehicle is 1500. 112020 112021 112023 112026 Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000. The 2019 and 2021 Audi e-Tron also qualifies.

So based on the date of your purchase TurboTax is correct stating that the credit is not. Then from October 2019 to March 2020 the credit drops to 1875. By Joey Klender.

Posted on May 4 2021. 1 Best answer. State Local and Utility Incentives.

If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. So weve got 5500 off a new EV purchase or lease and 3000 off of used. March 14 2022 528 AM.

Many leased EVs also qualify for a credit of 2000 this year and then 1500 for leases made between Jan. Both the state and the federal government have tax credits that you can take advantage of when purchasing an electric vehicle. The table below outlines the tax credits for qualifying vehicles.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data listed above plus a check box for Purchased New and the 5000 amount on line 9 based on the size of the battery I think. The dates above reflect the extension.

The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. The bill HB 1247 which would keep in place the existing. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs.

Nissan is expected to be the third manufacturer to hit the limit but. Restaurants In Erie County Lawsuit. Opry Mills Breakfast Restaurants.

The credit is refundable. New EV and PHEV buyers can claim a 5000 credit on their income tax return. The rate is currently set at 26 in 2022 and 22 in 2023.

To the extent that the amount of the credit exceeds tax the excess credit is refunded to the taxpayer. Colorado Electric Vehicle Tax Credit. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted.

Are Dental Implants Tax Deductible In Ireland. Which Is More Reliable. A proposal to extend Colorados tax credit out to 2021 was approved last Friday by a 40-21 vote in the states House of Representatives.

Depending on your location state and local utility incentives may be available for electric vehicles and solar systems. Tesla Tax Credit 2021 North Carolina. Registered in Colorado to qualify for the credit.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Zero Emission Vehicle Tax Credits Colorado Energy Office

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Colorado Ev Incentives Ev Connect

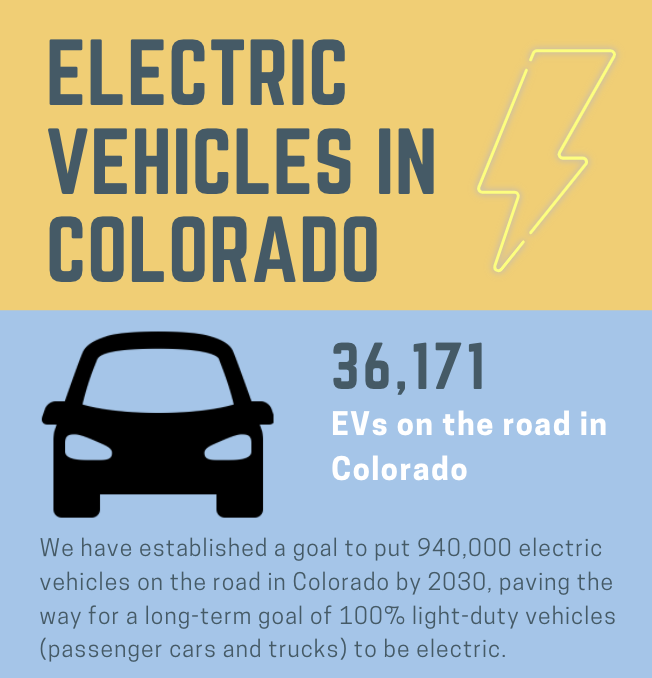

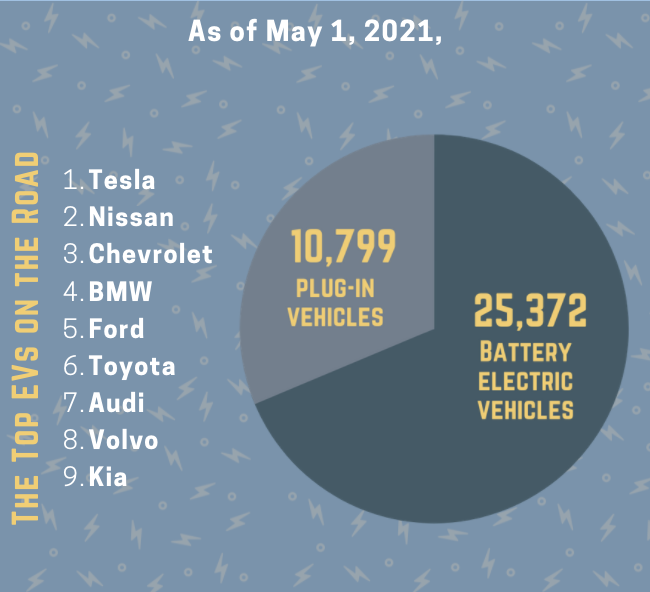

Electric Vehicles In Colorado Report May 2021

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Freewire Boost Charger Ribbon Cutting In Estes Park Drive Electric Colorado

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Electric Vehicles In Colorado Report May 2021

Colorado Ev Clubs Drive Electric Colorado

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Tax Credits Drive Electric Northern Colorado

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Which Tesla To Buy Is Tesla Fsd Worth It What About Other Evs Cleantechnica

Latest On Tesla Ev Tax Credit March 2022

Tesla Sees 1st Ever Annual Profit But Misses Estimates Daily Sabah